Employee benefit plans are not straightforward and require careful attention to make sure they are handled and filed correctly.

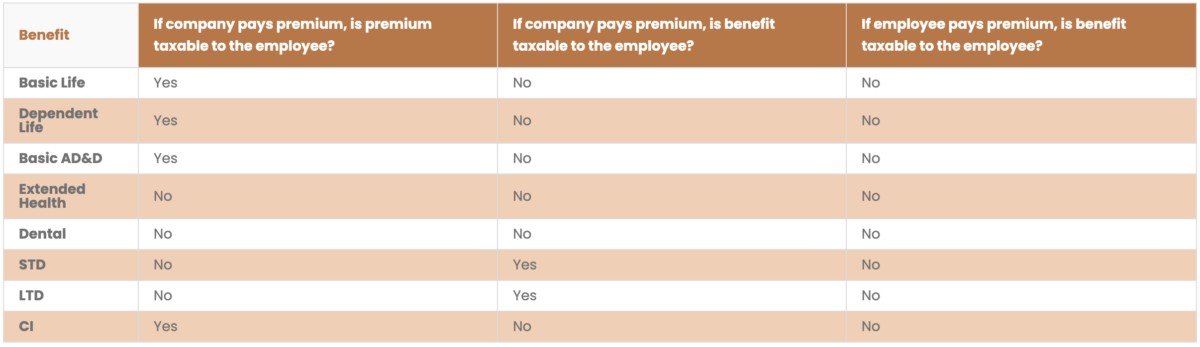

The tax implications change depending on which benefit it is and who pays the premium.

Below is a chart that shows the tax impact of each benefit if the company pays the premium versus if the employee pays the premium:

If the company pays the premium for life insurance, accidental death & dismemberment, dependant life insurance or critical illness, the premium amount should be allocated as a taxable benefit on the employees’ T4 each year.

If the company pays even $1 of the premiums for long-term disability (LTD) or short-term disability (STD), the benefit amount is considered taxable income to the employee. If the employee pays the full premium including the tax, this is not considered taxable income.

STD and LTD are not considered a taxable benefit on the employees’ T4.

Extended health and dental benefits can be paid by the company without any taxable impact to the employee and this is also true if there is cost-sharing of these benefits with the employee.

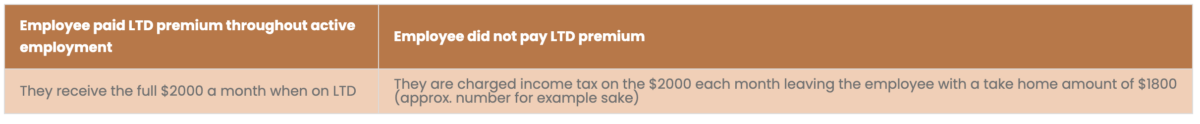

Below is an example on how the different benefits would be taxed.

I.e. An employee is eligible for $2000 a month on LTD

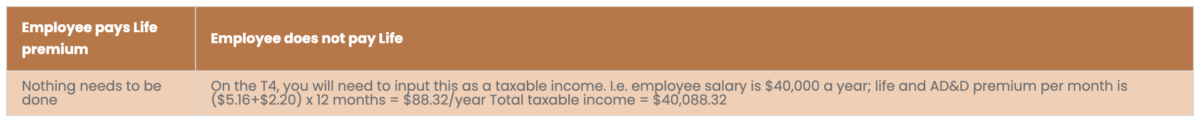

Life & AD&D premium

These amounts should be updated yearly to account for salary changes to employees and the price changes of the benefits.

Disclaimer: Valid as of January 2021 and is subject to change. Please ask your account for more details of how this applies to your plan.

Article Provided by Continuum II